How Much Should Accounting Cost a Small Business? Costs & Averages

Most states require you to take 40 hours of continuing education each year. Depending on what platform and provider you use for your CPE, it could cost $20 per hour on up to $125 per hour. After you have successfully completed all four sections of the CPA exam and you have completed the AICPA ethics exam, you will need to pay your CPA licensing fees to your state board. Many states require you to take and pass an ethics exam after you have completed the uniform CPA exam in order to get your CPA license. This isn’t a big deal as far as tests go, but like all things, it isn’t free either. In this article, we’ll focus on the cost of online CPA services like those that Xendoo offers.

This can include state and federal income tax returns, payroll tax returns, and sales and use tax returns. CPAs are required to maintain their tax and accounting knowledge with continuing education each year, so they’re familiar with the latest How much does a cpa cost tax changes. Audits are the most expensive level of service a CPA provides in this area since they take the most time. According to Audit Analytics, for audit-related fees, CPAs charge an average of $548 per $1 million in revenue in 2019.

Here’s a look at different services a CPA might provide and the estimated cost for performing these services. However, the benefits of professional accounting and tax assistance can outweigh the expenses. These engagements usually have well-defined scopes of work, allowing the CPA to determine a flat fee based on the anticipated time and resources required. Even if you’re a good accountant and know what you’re doing, the tax code has grown so complex over the years that even tax professionals have trouble deciphering it all. It is worth hiring a CPA as they provide valuable expertise and assistance with financial matters. In this article, I’ll outline the cost of hiring a CPA, the structure of payment, and the various components that contribute to the overall cost.

How Do Tax Preparers Set Their Prices?

On top of that, many CPAs don’t know what costs might come into play until they actually start doing your return. Here are some of the biggest factors that could increase the cost of working with a CPA firm. Hiring a Certified Public Accountant for your LLC can provide valuable financial expertise and ensure compliance with complex tax regulations. Ask them questions about their rates, hours of operation, customer service, and any discounts offered.

It helps you handle finances in a cost-efficient manner and build resilience by increasing payroll accuracy. My Count Solutions provide the best services that strengthen the backbone of any business by providing auditing, payroll, and tax preparation services. If they do offer bookkeeping, you’ll likely incur the cost of these services at the higher firm-rate, contrary to paying a separate bookkeeping service to maintain your financial records. We see syndications make huge mistakes when budgeting for accounting fees. Often we will see a budget contain only $800 for the entire year for all accounting and tax preparation services.

- A flat fee, perhaps the simplest of all, lets you know precisely how much you’ll be paying before your taxes are filed.

- Additionally, junior employees get paid between $60 and $120 per hour.

- Fortunately, there are some services that a public accounting firm won’t charge clients for if they’re paying for something else.

- Tax preparation is a service many CPAs charge based on how much time and effort it takes them to complete your taxes.

- ⇨ Audio course – if you’re more comfortable with audio, check if the course that you are considering offers this feature.

Remember, the hourly cost of hiring a CPA depends significantly on the type of work you need them to do. As you might expect, the more complex and involved the work, the higher the hourly rate is likely to be. Fortunately, small businesses usually don’t need to hire a CPA full-time. Most can get by paying for CPA services intermittently throughout the year, such as calendar year-end, tax season, and before significant decisions. A Certified Public Accountant (CPA) is one of the most beneficial service providers you can hire as a small business owner. In addition to helping you complete and file your annual tax return, they can provide valuable tax and business planning during the year.

Average cost of tax preparation by a CPA

A CPA’s rate structure will impact how much you pay for professional tax preparation services. Some CPAs charge by the hour while others charge a flat fee, but charging per tax form is also extremely common. When you pay a professional to do your taxes, you are getting the added benefit of numerous other services, including accounting, record-keeping, tax consultation, and auditing. You can also hire an accountant who has a particular specialization, for example, if you own a small business or live abroad.

These costs are typically arranged in a tiered fashion allowing you to save money by signing up for multiple sections at one time. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or financial advice. You should engage a qualified tax professional or accountant to evaluate your business and help determine applicable tax and legal obligations. While cost is an important consideration, it’s equally important to prioritize value and quality when engaging a team to support your small business.

- The average cost of accounting services for small business differs for each unique situation.

- Ultimately, our goal is to make quality CPA Exam preparation attainable to anyone, regardless of your financial situation.

- When engaging a CPA, discussing the scope of work, services needed, and any potential additional charges is advisable.

If you’re a small business owner, managing your financial books is not an expense you want draining your bank account. But, it can be difficult to know if your accounting costs are on track. The IRS does not make it compulsory to engage a tax professional. Also, you can make mistakes that put you in trouble with the IRS, which will often cost you more time and money than when you hire a professional.

Filing a personal income tax return costs an additional $294 (or $188 if you take the standard deduction instead of itemizing). To assist you in saving money on your taxes, a professional CPA will examine your specific tax position. You may anticipate spending more for your CPA’s services the longer it takes them to finish your taxes.

How much should accounting cost a small business?

Use programs like TurboTax, FreeTaxUSA, and H&R Block to calculate and file your own tax return. Gather all necessary tax documents, such as income and expense records, to streamline the tax preparation process. Here’s how to lower the average cost of tax preparation by CPA for small business. Let’s break down the average cost of tax preparation according to the CPA form.

Attending UCLA as a California resident will cost you over $100k, and net you roughly 120 semester-equivalent hours towards the required 150 hours of public accounting you need. Let’s move onto the next phase where you’ll obtain the remaining 30 hours needed. Accountants typically hold professional certifications such as Certified Public Accountant (CPA) or Chartered Accountant (CA). They can charge higher fees than tax preparers because of their broader expertise and qualifications.

You can also compare the costs and benefits of outsourcing some tasks that you can do using software or other methods. It is a challenging exam that assesses one’s knowledge of tax law and standard accounting procedures. Moreover, it also involves obtaining a state license that includes ethical criteria. You probably prefer to do almost anything other than pour over your accounts and tax documents. Thankfully, there are skilled folks out there who would be familiar with the complexities of taxes and can assess them for you.

What does a Certified Public Accountant (CPA) mean, and what does a CPA do?

Depending on the nature of the business and the requirement, you can better decide how much you are willing to pay a CPA. The average CPA cost was $119,000 per year, while the cost of a fresh CPA was $66,000. However a CPA with more then two decade of experience can cost $152,000 per year. Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. While you might think your attitude towards bookkeeping is trivial compared to cold hard cash, it affects your business.

Should you hire a CPA to prepare your taxes?

They will learn about your family or business’s financial records and goals. They can give valuable advice and personal tax reduction suggestions and answers to critical questions at any time of the year. It’s crucial to have your books in order well before tax season. Your CPA has to work off of an accurate reflection of your financials. So the more errors there are in your books, the longer a firm’s CPA or bookkeeper has to spend working on them.

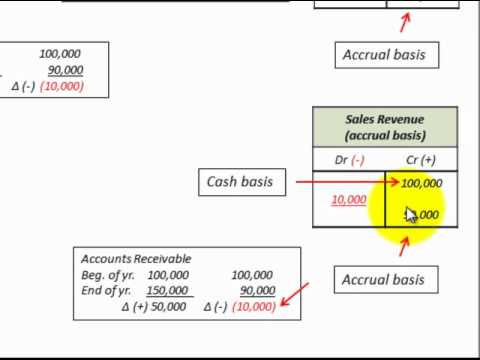

Financial statements and auditing

You must meet eligibility requirements and enroll in the program. Once enrolled, your Account must remain in good standing with a deposit and spending history that meets our discretionary requirements to maintain access to the feature. BalanceUp overdraft limits of $20-$200 are provided at our sole discretion, and may be revoked any time, with or without notice.